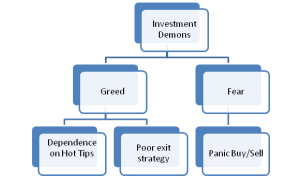

The twin demons of fear and greed can destroy the soundest of investment strategies. No we are not on a moralistic religious talk here. We are taking of two all pervading invaders who destroy our investments.

Be satisfied – aim higher – two contrary ideas which are drilled into the Indian psyche. Both of them are at a constant battle. The virtue of being satisfied with little has been drilled into us and yet very contrarily, we also taught to aim higher. To seek more than what we have, to be the best.

In the investing world, one often hears about the consensus between value investing and growth investing. And although understanding these two strategies is fundamental to building a personal investment strategy, we are often swayed by ‘hot tips’ and ‘insider information’ that can change our life. All the common sense and fundamentals analysis flies out of the mind replaced by greed – shinning and inviting.

Greed Governs

Most of us have a desire to acquire as much wealth as possible in the shortest amount of time and why not? Unfortunately this may take us to the level of being imprudent in our investment decisions.

This get-rich-quick attitude makes it hard to maintain gains and keep to a strict investment plan over the long term.

Beat the greed

Any prudent investment approach should contain some form of an exit strategy; simply put how you plan on getting out of the stock you hold.

This would be one way to avoid greed, have a set price at which you intend on selling the stock, WALK AWAY with the money in your pocket and move on to the next investment. It sounds like a simple doable idea but one tends to ignore this essential strategy when the market is on the upswing. Holding on for a little higher returns may often cost us too much.

Fear Festers

When stocks suffer large losses for a sustained period, the overall market and the individual investor can become more fearful of sustaining further losses. But being too fearful can be just as costly as being too greedy.

Fear can make you take panicked decisions which do not match with your long term investment strategy. Getting swept up in the prevailing fear of the overall market by switching to low-risk, low-return investments can set you back by years in your financial planning.

Countering fear

The best way to counter fear is to have a financial plan in place and keep the eye on the goal. It is also important to choose a suitable asset allocation mix. The herd mentality will only help keep the head down and give grass to gaze.

‘We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.’ – Warren Buffet